The OECD-FAO Agricultural Outlook 2021-2030 expects global meat supply to reach 374 million tons by 2030. Herd and flock expansion, especially in America and China, added to higher productivity per animal (average slaughter weight, improved rearing and feedstuff formulas), will drive this rise. The report’s chapter dedicated to meat can be downloaded from this link to our page on meat sector legislation and documents of interest (in Spanish). Some of the main conclusions of the report are:

- China is expected to account for most of the total increase in meat production, followed by Brazil and the United States.

- The increase in global meat production will mainly be driven by the rise in poultry production.

- The growth in pork production will be limited during the first three years due to the slow recovery from ASF outbreaks in China, the Philippines, and Vietnam. The recovery process is expected to be completed by 2023, especially in China, thanks to the rapid development of large-scale production facilities that can guarantee biosecurity.

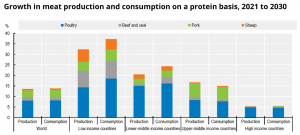

- According to the report, global meat protein consumption over the next decade will increase 14%, largely driven by income and population growth.

- The availability of beef, pork, poultry, and sheep protein will grow 5.9%, 13.1%, 17.8%, and 15.7% by 2030, respectively.

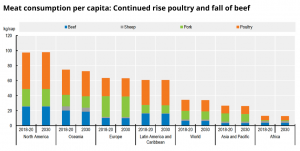

- Meat consumption is increasingly shifting towards poultry. In lower-income countries, this is due to its lower price compared to other types of meat; while in high-income countries, white meats are preferred, as they are easier to prepare and are perceived as a healthier food choice.

- Globally, poultry is expected to account for 41% of all meat-based proteins by 2030, a 2% increase compared to the baseline period. The global share of other meats is lower: beef (20%), pork (34%), and sheep (5%).

- International meat trade will expand in response to the growing demand from countries in Asia and the Middle East, where production will still be insufficient to meet the demand.

- Nominal prices for beef, pork, and poultry are expected to bounce back in 2021, as demand in high-income countries recovers from the COVID-19 pandemic. Further increases, although modest, are expected until 2025, as income and consumer spending are expected to pick up in other countries, especially middle-income countries.

- Greenhouse gas (GHG) emissions from meat production represented about 54% of total emissions from agriculture during the 2018-2020 baseline period (based on CO2 eq.). The 5% increase in meat sector emissions by 2030 is considerably lower than the growth in meat production, mainly due to the contribution of poultry production and the higher meat production expected from a given stock of animals. The adoption of new technologies to reduce methane emissions and food supplements not widely available today could further reduce emissions per unit.

These projections are based on the assumption that consumer preferences will evolve following historical patterns, and that both income and prices will determine people’s diets. However, other factors that could influence meat’s outlook in the medium term are changes in consumer preferences and the increasingly rapid drop in meat protein consumption.

The emergence, although minor, of alternative protein sources such as crop- and plant-based meat substitutes, added to the automation of the labor-intensive processing, packaging (including labeling), and distribution sectors, will also impact these estimates.